The Role of an Executor and How to Choose One

When you’re writing your Will, one of the key decisions you’ll need to make is choosing who will be accountable for carrying out your wishes. This person is referred to as the executor. The name itself sounds like a superhero character and in truth, they sort of are!

Whether you’re getting ready to make a Will online, update your existing Will, or if someone has asked you to be their executor, the role of an executor comes with a lot of responsibility. For that reason, it makes good sense to understand what’s involved in the role before you choose ‘the one’ or accept the task yourself.

What is the role of an executor?

What are the costs associated with executorship?

The pros and cons of choosing a professional vs. a non-professional

Checklist to choosing an executor

FAQs

What is an executor?

Executors are the superheroes in the last chapter of our story. They are the ones who don their capes and take on a focused mission to carry out the final wishes that were laid out in your Will. Executors of Wills are appointed by the testator (the writer of the Will) or by a court in the case that there was no Will at the time of passing.

What is the role of an executor?

The role of an executor is complex and just like superheroes, the person should possess certain abilities and skills to be able to play the part well – skills such as having a solid understanding of business, tax, and accounting. They should also be aware of the risks and personal financial liability factors involved.

Your executor’s first job is to obtain probate (though strictly speaking this doesn’t have to be the executor, it just often is). Probate is when the court gives permission for the executor to administer your estate. Only then can they start the next step, which is the estate administration process.

Here are just some of the tasks your executor will need to do:

Apply for probate from the Supreme Court

Identify, secure, collect, and evaluate your assets

Advertise for creditors

Find and contact your beneficiaries

Pay any outstanding debt & expenses

Claim insurance or any entitlements

Close bank accounts, transfer ownership of joint assets, and cancel any credit cards or subscriptions

Complete an end-of-life tax return

Distribute all the assets to the beneficiaries in the Will

Choosing a personal or professional executor

The role of the executor is extremely important and comes with a significant amount of responsibility. Many people don’t realise that executors are legally, personally, and financially liable for the work they do. Should they make a mistake negatively impacting beneficiaries, whether they are a personal or professional executor, they could have to pay out of their own pocket to cover the costs.

Selecting an executor is a personal decision that can be impacted by many factors. One common factor is the cost. The perception can often be that a family member or friend will be much cheaper. Though it is likely they may not charge for their time, it’s estimated that 95% of personal executors end up engaging a professional to help them navigate the probate and estate administration process and though rates will vary, you could estimate $400 -$600 per hour. Therefore, the savings might not be as great as what was assumed, and the administration costs and associated liabilities may still apply.

Professional executors:

Will be insured for legal liability

Will charge for their time and costs

Are experienced and therefore know how to navigate the legal and financial requirements quickly

Usually have all resources including specialists in one place for easy access

Are unbiased and not grieving while working through the process

Are experienced in supporting grieving and/or disputing family members

The costs associated with executorship

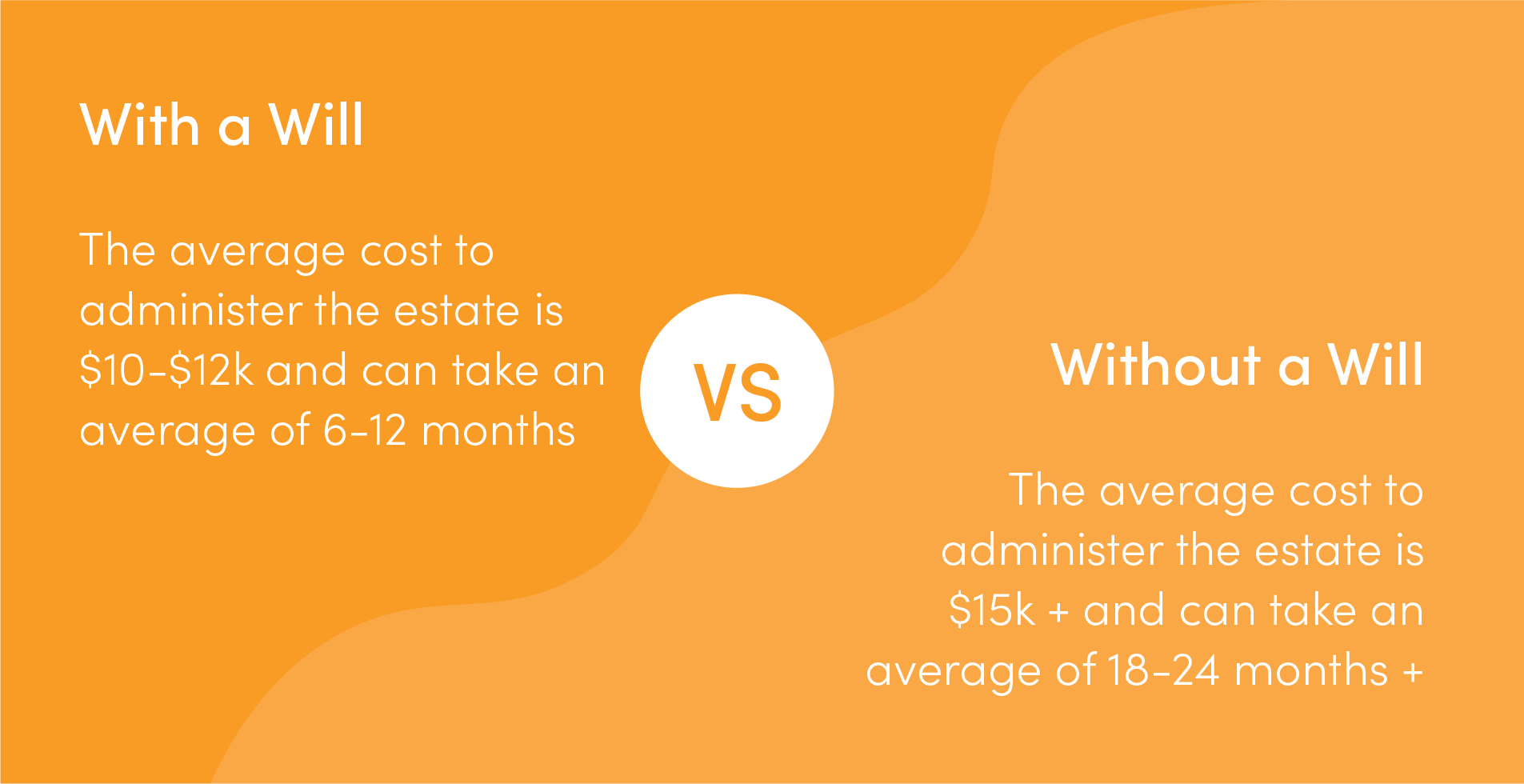

The average fee to administer an estate in New Zealand when there is a Will currently sits between $10k-$12k (individual cases vary), and without a Will, this amount goes up by an estimated 50% costing an average of $15k or more.

Traditionally, these fees come out of the estate as part of the bill. Lawyers and some trustee companies will often charge by time and costs or a percentage of the estate. To help reduce your costs and save thousands on your estate administration fees, you can check out our exclusive probate and estate administration pricing or our unique Footprint Rewards program where you get a $100 discount off your fees when you join, and every year your subscription renews. T&Cs apply.

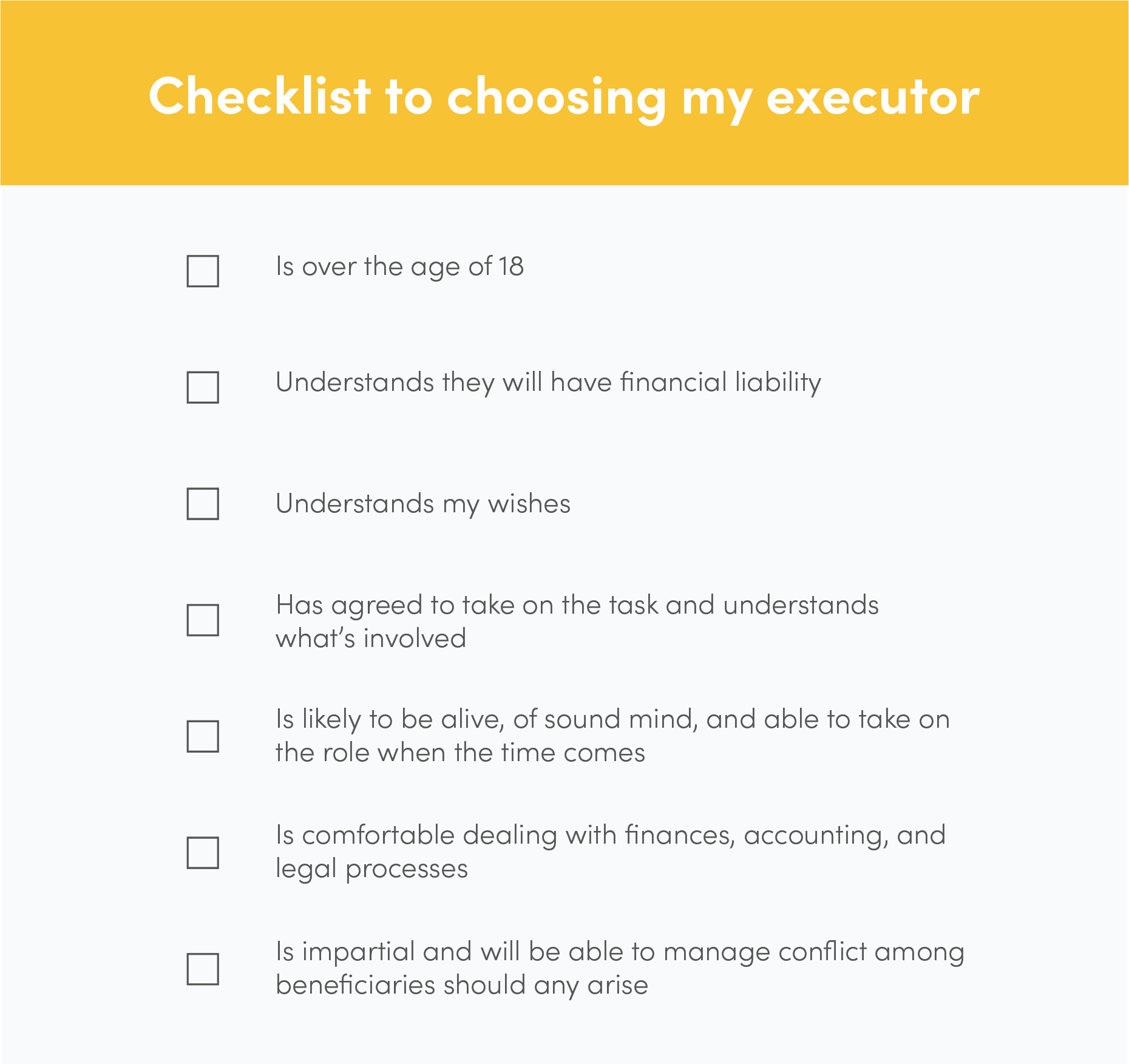

Checklist to choosing an executor

Now to the decision-making! When choosing your executor, there are a few things you should consider:

Age and health: If they’re older than you or unwell, there is a risk of them not being around or sound enough to administer your stuff when you pass. If that’s the case someone else will need to step in and it might not be a person you would have wanted.

The skills & time: Unless your executor knows what they’re doing, the tasks involved aren’t particularly straightforward, and they certainly can’t all be done in one day. Consider whether the person you choose will have the time and the capability to do what they need to.

Impartial and comfortable interacting with others: Your executor will need to interact with all sorts of people like lawyers, accountants, and more importantly, your family and the beneficiaries in your Will. Choosing someone who is impartial and capable of dealing with a variety of people will make it much easier, especially if there’s the possibility of conflict or existing disputes within the family.

Your relationship: Many people appoint their spouse or children as their executor because they’re likely to know and trust them the most. Although they may seem best suited for the role, they might need some time to grieve.

The financial situation of your executor should also be considered. Being financially liable for any mistakes they make that negatively impact beneficiaries could mean they have to pay out of their own pocket to rectify the situation.

FAQs

Can my executor contest my Will?

Technically no, your executor is legally responsible to abide by what’s written in the Will, however, there are a few scenarios when someone could challenge a Will and that’s when it falls into one of these three acts: The Family Protection Act (FPA), the Property Relationships Act (PRA), and the Testamentary Promises Act (TPA).

The Family Protection Act: If you have children who you are not including in your Will or you are providing for unequally.

The Property Relationships Act: If you’ve been with a partner for more than three years or have children together and you don’t include them in your Will.

The Testamentary Promises Act: If you’ve promised to include someone in your Will who has provided you with a service but then don’t.

Does my executor get paid for their work?

If you appointed a non-professional as your executor, they can get paid for their services but only if you choose to provide that in the Will. Alternatively, if you choose to hire the services of a professional, we offer exclusive pricing on probate and estate administration services to those who select Perpetual Guardian as their executor in their Footprint Will.

What if my executor dies before me? / What if my executor can’t take on the role?

If you appointed a professional executor, then there will always be an experienced person to administer your estate because you selected a business, not one specific person. If you appointed a personal executor as well as nominated a backup executor—which you can do with a Footprint online Will—then the responsibility would fall onto them. Without a backup, someone close to you could go through a legal process to apply for the right to administer your estate. This means you could end up with someone who wouldn’t have been your preferred option.

To minimise your risks of having an executor switch-around situation, here are a few things you can do:

Review your Will every year or whenever something big changes in your life (i.e., if your executor passes or you no longer have a relationship with them).

Talk to your executor before appointing them in your Will and ensure they understand the tasks and the financial liability they would be taking on.

Nominate a substitute executor in case your first choice can’t or doesn’t want to do the task.

Consider appointing a professional as your executor or sub-executor. They can provide impartiality and you can be assured someone will always be available. In this scenario, you can also nominate a family member or friend as an advisory trustee which is someone who could advise your executor on your wishes without having any of the liability.

Can I appoint one of my children as my executor even if they’re in my Will?

In short, yes, it’s legal to have an executor who’s also a beneficiary in your Will. Ultimately, it’s totally your call but we think it’s a good idea to keep the beneficiaries of your estate and your executor separate, and here are just a few reasons why...

Should your Will be challenged, it could be seen as a conflict of interest.

If you have more than one child, there is the risk of potential conflict between them or other family members (this happens more than you might think).

They will be held financially liable if they make any mistakes impacting the beneficiaries.

They will likely be grieving your loss all while having to settle your estate which could take months of their time.

Learn more about executors, Wills, and estates through Footprint

If you’re thinking about creating a Will or updating an existing one, explore our Will packages and Will information to learn more about creating a Will through Footprint.